Dear reader, I have a confession to make. With over 20 years’ experience in digital marketing, and despite accepting that online advertising revenue fuels much of the free and open internet that we all love, I use an ad blocker. I know it’s wrong, but even a cynical marketing geek like me feels that many aspects of online advertising need improvement and in some cases re-engineering. These are big issues and mighty relevant in the context of international paid media, because understanding how ad blocking and privacy issues vary across markets can and should be used to shape your global media strategy and execution.

The big picture

The short version is this:

- Ad blocking usage varies widely across international markets. Usage data should be deployed to better inform market selection, paid media planning, forecasting and analysis.

- Privacy concerns also vary across markets. This information provides useful insight into consumer behaviours, and how brands should address privacy concerns via advertising, messaging and their ‘owned’ media.

In other words, using data to better gauge consumers’ behaviour in relation to ‘privacy’ (i.e. all items above) will help brands make more optimised decisions about which markets provide the best opportunity for paid media.

Attitudes to data privacy vary across markets and demographics

Understanding global views on privacy provide foundations for our understanding, and the GDMA’s 2018 report on Global Data Privacy is a good starting place:

Over half (51%) of consumers across 10 global markets are Data Pragmatists; people who are happy to exchange data with businesses so long as there is a clear benefit for doing so. Just over a quarter (26%) of global consumers are Data Unconcerned; people who show little or no concern about the use or collection of their personal data. Less than 1 in 4 (23%) fall into the Data Fundamentalist segment; people who are unwilling to share personal information under any circumstances. Consequently, it is now the vast majority of global consumers (77%) who show no fundamental objection to engaging in the data economy, demonstrating fertile ground for the future.

And here’s the GDMA data across selected markets:

Also, note that attitudes towards privacy vary across generations:

For example, younger consumers globally are far more aligned to the unconcerned mindset compared to older age groups. This is most apparent in Germany where 58% of 18-24 year olds are Data Unconcerned. But this trend is apparent across all markets. For instance, 43% of 18-24 year olds in Argentina are Data Unconcerned, compared to 20% of those aged 65 and over. At the same time, older consumers are much more likely to be Data Fundamentalists. In Australia, for example, 38% of consumers aged 65+ are Data Fundamentalists compared to 15% of consumers aged 18-24. To highlight this trend even further, in the USA 38% of older consumers are Data Fundamentalists compared to just 12% of 18-24 year old consumers.

What drives differences across markets? Economic factors play a key role according to the ECIS 2018 report (which explores online privacy and security attitudes from 24,143 individuals across 24 countries):

Our findings show that, compared to those living in developed nations, people in countries with lower economic living standards tend to have lower online privacy concerns in regard to personal information being monitored or bought and sold. Such individuals are also relatively less concerned about a general lack of privacy due to having so much personal information about themselves on the web. These findings are aligned with the notion that privacy concern decreases with lower household income (Acquisti and Grossklags, 2006).

Ad blocking – what’s the story?

Let’s be more specific – what about ad blocking? Is it ad-mageddon? Well, there is some concern…for example via The Drum:

The UK has one of the highest rates of ad blocking worldwide, with over a third (39%) of page views blocking ads, resulting in a loss of more than £2.9bn in publisher revenue in 2017, according to report by OnAudience.com.

Yikes! And what about beyond the UK? This again via The Drum:

For those who need evidence that consumers are sending us a message, a recent study revealed that the inclination to download adblocking software has risen to 90% in Asia Pacific. This is especially an issue in the mobile-first world of APAC, as customers are paying with their data for irrelevant ads, which take ages to load and ruin their experience.

And it may be costing advertisers a few… billion dollars:

These kinds of estimates are inherently difficult to validate, and there are counter-arguments which suggest that ad blocking will encourage better quality ads and hence (with superior engagement and performance) improved revenues for publishers as inventory becomes more ‘premium’.

But accurate data is available to better illuminate ad blocking facts, figures and trends. For example, this via IPSOS MORI:

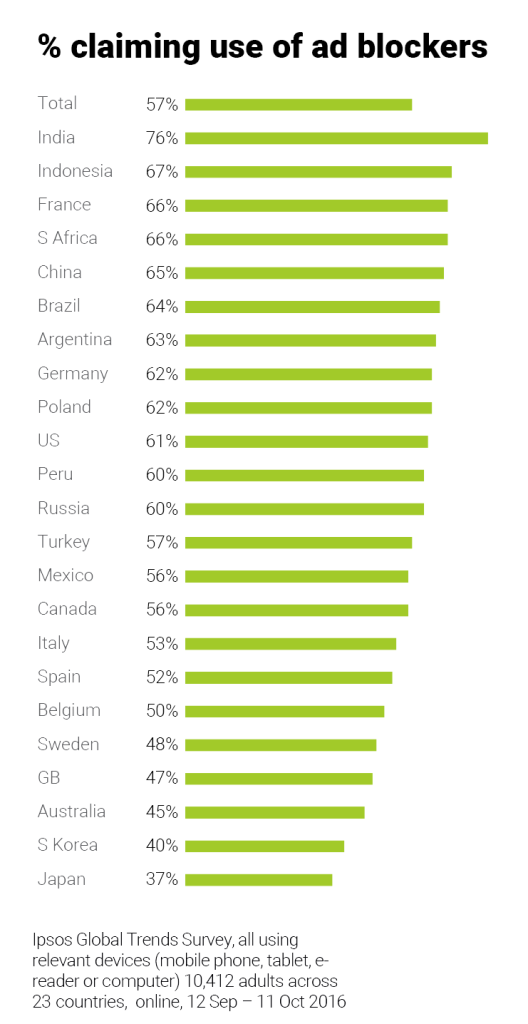

The most alarming statistic for advertisers is that more than half of internet users globally (57%) claim to block ads – either by using ad blocking software or manually closing out of ads. Regardless of whether these people actively use ad blockers or are just exiting or actively ignoring ads, it is a concern for the advertising industry. Ad blocking is most common in emerging economies, with India topping the list with 76% claiming to use ad blockers.

What about trends? Well, ad blocking is definitely in ascent across the world on desktop and, increasingly, on mobile:

Ad blocking shows significant adoption in top markets by ad spend. 3 of the top 10 markets (Germany, Australia. Canada) show 20% + use.

And ad block use by device type varies widely across markets:

Another pertinent question is what motivates people to use ad blockers? This via Marketing Land:

While there are many different reasons given for using an ad blocker, the bottom-line motivation is pretty simple. Either users are sick of being bombarded by ads and experiencing their effects on the user experience, or they have security or privacy concerns.

If I were writing a confession, I would tell a tale about how I nearly lost my sanity as my mobile phone choked on a 20-slide, “click-bait”-style gallery. It was ever resizing, lagging, and ads kept “enlarging” where the “next” button was located, causing me to click an ad instead of the next button. Yes, this was even on WiFi.

That was when I began using ad blockers on my desktop and phone. Maybe it was one of the first cases of PTAD (Post Traumatic Ad Disorder) ever recorded. I’m getting long in the tooth and don’t appreciate having my precious remaining moments sucked up by ads.

Let’s frame this with some data. First, via Hubspot:

Second, via Page Fair:

NB security and privacy @ 36%

And finally, via Global Web Index:

Looks like primary motivations are all about intrusive and annoying ads, with privacy/security taking a clear second place. And IAB agrees:

Among those that already use an ad blocker on their PC, the top reason for using it on a computer is the perception that sites are easier to navigate without ads. Among those that already use an ad blocker on their smartphone, the top reason for using it on a phone is the perception that ads slow down browsing. Consumers that use ad blockers tend to blame ads for slow loading.

Lots of data to digest, so let’s summarise:

- Younger consumers globally are far more aligned to the unconcerned (less bothered about data privacy) mindset compared to older age groups.

- People in countries with lower economic living standards tend to have lower online privacy concerns…

- ….yet some emerging economies have the highest rates of ad blocking e.g. India, Brazil, Mexico.

- Ad-blocking may be costing publishers billions of dollars globally.

- More than half of internet users globally (57%) claim to block ads.

- Mobile ad blocking use has overtaken desktop use.

- Among those that already use an ad blocker on their smartphone, the top reason for using it on a phone is the perception that ads slow down browsing.

- So although online privacy is a significant concern across some markets and demographics, better user experience (UX) is the prime motivator for ad block use.

The cost impact of ad blocking

As outlined above, a range of studies and commentaries suggest that ad blocking is costing publishers a great deal of money, possibly multiple billions of dollars a year. Many publishers have adjusted either business models (decreasing reliance on ad revenue) or UX principles (encouraging users to turn off ad blockers) to mitigate this impact.

But what about for advertisers? Are agencies and brands paying for impressions that will never be delivered? Let’s frame this in the context of the kind of paid media campaign you are focused on.

First, for pay per click (PPC) media, there is no cost impact. Advertisers only pay for clicks, so if an ad is not served due to ad blocking, it cannot be clicked on. No cost! This applies to paid search (Google AdWords, Baidu PPC, Microsoft Advertising, many types of Facebook ads, etc…). But this doesn’t mean there is no impact; see below for details. Most advertisers pay ad platforms directly for PPC, so there is very little chance of any errors. All good.

Second, for campaigns where costs are based on impressions served, ads delivered via Google are Active View compliant with the industry standards for the viewability of online ads. For example, a display ad is considered viewable when at least 50% of its area is visible for at least 1 second. A video ad is considered viewable when at least 50% of its area is visible while the video is playing for at least 2 seconds (for more details, see here). In other words, if ad serving is blocked by an ad blocker, the ad is non-viewable, and the impression will not be charged. And this is the case for all networks and publishers who comply with industry rules. Ads may not be viewable when.

- The user leaves the page before 1 second is up

- The user doesn’t scroll down far enough to see the ad

- The user has ad-blocking software enabled

- The page is being opened by a proxy server, crawler or spider (not a real person)

- The user’s computer is missing a necessary plug-in to display interactive media

- The user tries to open the page in a device that isn’t enabled

So no-one should be paying for ad blocked impressions. Phew…except that there are some technical exceptions to consider:

‘Ad blocking techniques or software that prevents any requests to the Ad Manager domain may have no impact on the impression measurement as this situation may prevent both the ad request and the measurement, resulting in an accurate count of zero impressions.

However, ad blocking software that blocks images or content from the creative server, but not Ad Manager ad servers, may result in an overstatement if the ad request is processed and counted, but the browser subsequently prevents the display of the ad creative. Additionally, certain ad blocking tools may also be customized by the user to block content based on the image size. The software compares the size of the image/creative to the set parameters of the filter and if it matches the parameters, the image is blocked, potentially resulting in an overstatement of the impression.’ (via Google Ad Manager Help)

It does not seem (currently) possible to isolate the potential impact of this issue, but given the paucity of coverage available online, we can assume that it is negligible/minimal. For now.

And finally, any brands who engage in ‘pure’ pay for performance models (e.g fixed cost per acquisition (CPA) or cost per lead (CP) programmes) will not experience cost impacts via ad blocking – you should only be paying for valid sales or leads.

But that’s not the whole story.

The planning (via forecasting) impact of ad blocking

Let’s first review a simple forecasting model for a single digital channel, where estimated sales are calculated as follows:

Sales volume = Clicks (website visits) / conversion rate

where

Clicks = impressions / click-through rate

And now with numbers:

![]()

NB we assume that a number of channel specific forecasts will form components of your eventual (and likely much more complex) planning deliverable.

Obviously, a decrease in impressions – let’s say by 20% – has a direct and evident impact on sales volume:

![]()

But 20% is a very low adjustment to make for use of ad blockers! Taking some larger European and Nordic markets – Italy, Spain, Belgium, Sweden – ad block use is around 50%:

![]()

…which (obviously!) leads to a 50% drop is estimated sales volume.

Although there is no impact on CPA (so no cost impact for brands), if you’re forecasting and planning with a sales volume figure in mind, this forecast will be significantly compromised unless likely shortfalls in impressions caused by ad blocking rates are factored into your planning process.

Final thoughts – a distinct challenge for advertisers to consider.

Across all markets, the use of ad blockers creates challenges for effective digital marketing, in relation to planning/forecasting where ad block use should be factored into your forecasts and projections.

As we can see from this review, known and significant differences in ad block use across international markets should be used to refine your approach to market selection.

Sidebar:

Did you know that ad blocking (at least via some ad blockers) can be avoided by joining whitelist programmes? For example, Adblock plus can be bypassed via this and this as well.

The Adblock plus business model is controversial but it does present the advertiser with options.

Matt Owen | Director, Oban International

Matt Owen | Director, Oban International

Oban International is the digital marketing agency specialising in international expansion. Our LIME (Local In-Market Expert) Network provides up to date cultural input and insights from over 80 markets around the world, helping clients realise the best marketing opportunities and avoid the costliest mistakes.

Let’s accelerate action together

At Oban, we believe change happens when we act, support each other, and keep moving forward. These stories show how small steps can make a big difference. If you want to improve your digital marketing, get in touch. Let’s get started.