5 ways to improve international e‑commerce success with SEO, UX and CRO

5 ways to improve international e‑commerce success with SEO, UX and CRO

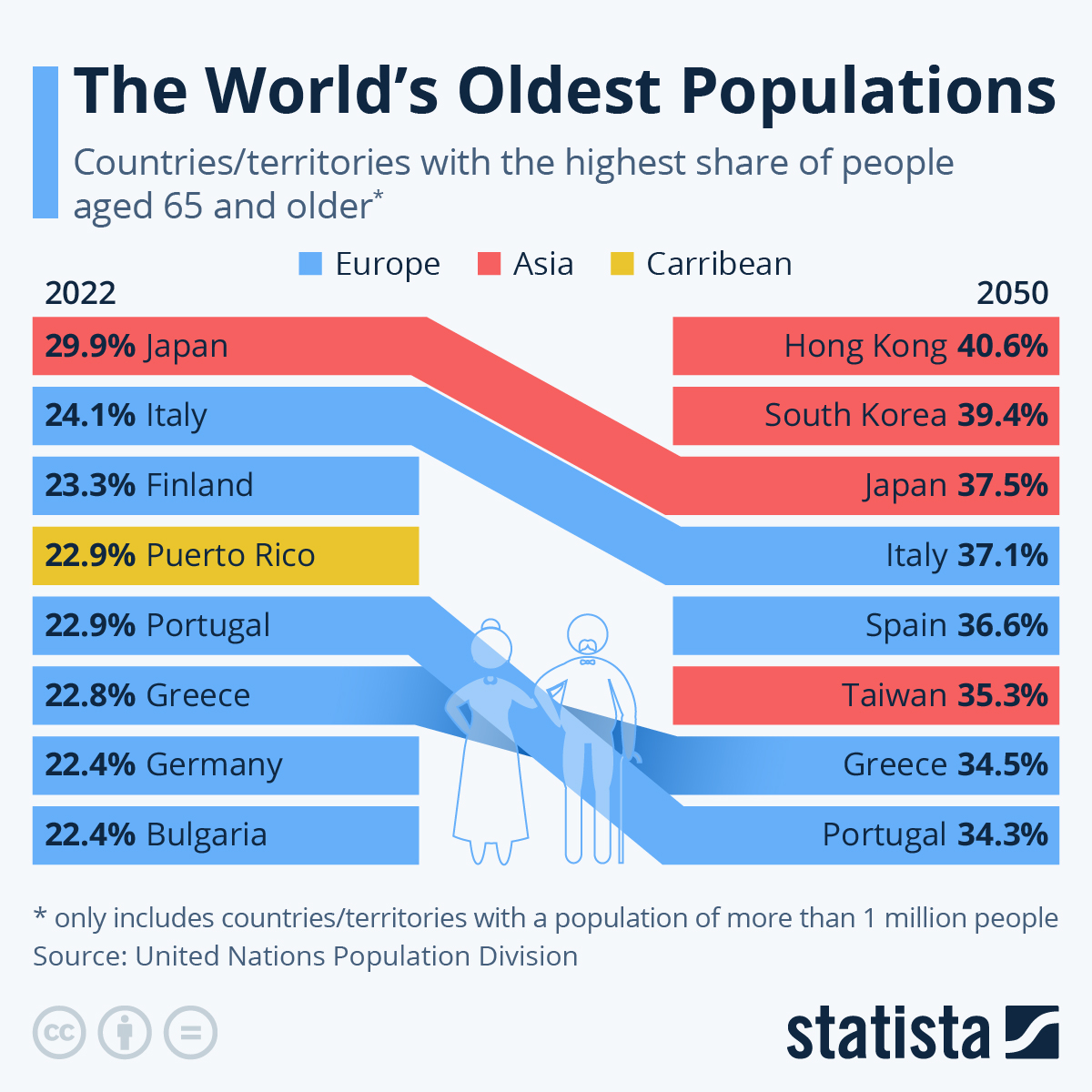

According to the UN, the number of people aged 65 and older is expected to double over the next three decades, reaching 1.6 billion in 2050. In many markets over 65s will account for over 1 in 3 of the population. Asia leads this trend, with Hong Kong, South Korea, and Japan expected to have the highest proportion of over 65s by 2050. The fact that people are living longer is a success story but also has significant implications for products, services, and marketing.

This chart from Statista shows the countries with the oldest populations today – and how this is expected to change by 2050:

Source: Statista, 2023

Source: Statista, 2023

For businesses, growing numbers of older people mean new or expanded groups of consumers to target, with specific requirements relating to their age and life stage. However, despite the emphasis on diversity and inclusion in recent years, many businesses remain ill- equipped to provide for or talk to older audiences.

Brands sometimes shy away from marketing to mature consumers, because of fears they may alienate their current, younger target groups. For example, in the UK, people over 75 buy five times as many cars as 18-24s, but you probably wouldn’t guess that based on most automotive advertising. Achieving success with both younger and older consumers – what might be considered ageless marketing – requires skilful balance.

Even when businesses decide to market to older audiences, they don’t always see the need to treat them differently. They may believe that mature consumers are not sufficiently different from younger ones in behaviour, attitudes and purchasing behaviours to justify treating them as a distinct consumer market, although this is rarely the case. They may also feel they don’t know older consumers well enough to market effectively to them.

Despite the challenges, overlooking older consumers is an error. Not only are they growing in number, but they also wield disproportionate wealth. Older consumers often feel their needs have not been met and feel overlooked by certain brands. A study by Gransnet and Mumsnet found that 78% of over-50s felt unrepresented or misrepresented by advertising.

Considering everyone over a certain age, such as 50, as part of the mature market and treating them the same way isn’t helpful. Firstly it is such a broad group and a working 50 year old will have more in common with working people in their forties than a long-retired 85 year old. Secondly, people don’t always identify with their chronological age. Research from around the world shows that before the age of 30, people tend to think of themselves as older than they are. After the age of 30, people tend to think of themselves as younger than they are. In other words, age is a subjective lens and different people think of themselves differently.

Consumer needs, including older consumer needs, are more likely to be shaped by individual lifestyle, financial, professional, or health circumstances – so these remain more useful ways to segment an audience. But more importantly…

This is because, thanks to globalisation, younger people around the world have been born in a more homogenous era – reflected in mass media, retail, educational opportunities, telecommunications, and technology. Therefore, their socialisation experiences have been more alike than older people who grew up in earlier, more diverse commercial environments. This also suggests that in time, as globalisation continues, consumers will become more homogenous globally.

The longer people live, the more likely they are to experience different events and circumstances that shape their behaviour and set them apart from other people with different sets of life experiences. Therefore, it’s credible to suggest that older consumers tend to be more heterogenous than their younger counterparts – which has implications for how you segment them.

Knowledge about consumers of one age group in one country may not apply to consumers of the same generation in another country. Marketing strategies which have proved effective in one country may not be effective in another. Cultural factors shape consumption habits, which is why it pays to consult a Local In-Market Expert to guide your approach. Aside from culture – such as the extent to which a country is individualist or collectivist – differences in consumption patterns can simply be a result of the options available to consumers.

As a generalisation, the more socio-political stability a country has experienced during the lifetime of its consumers, the smaller the differences in consumption patterns between generations. This is because seismic social or political or economic changes create different environments to which consumers are exposed at different life stages. An older consumer who has been exposed to diverse changes throughout their life will find their consumption habits have been shaped by those experiences.

There are different types of ageing – there’s biological or physical ageing and psychological or social ageing. Or, put another way, chronological ageing and subjective ageing. Consumer needs driven by physical ageing processes are more likely to be better predictors of similarities in consumer behaviour around the world – since the biophysical ageing process is similar in humans regardless of country or culture (even if life expectancies vary by country, especially between developed and developing societies). Social or psychological ageing is more likely to be shaped by cultural values. For example, as a generalisation, older adults may command more respect in eastern than western countries. In some societies, it’s the norm for adult children to provide for their elderly parents. In some western societies, there’s pressure on older people to look young for as long as possible.

There’s also the cohort effect to consider. A 60 year old in 2023 differs in terms of lifestyle, social attitudes, and buying behaviours and will have been shaped by different cultural influences than a 60 year old in 2003. So it’s important to check that your perceptions of how older consumers behave still rings true in the current environment.

For international marketers, it’s worth considering the different age profiles of your target markets. They can vary significantly – for example, the median age in the UK is 40.6 whereas in South Africa, it’s 28 and in Kenya, 20. And it’s worth looking ahead too, to see how different age groups are forecast to evolve in your target markets, since some countries are ageing more rapidly than others.

If you decide to target older consumers, segment them where possible by variables beyond just age – they are a diverse group, so it doesn’t make sense to group mature consumers into one bucket and treat them as though they are the same.

Consulting a Local In-Market Expect will help you understand cultural attitudes to ageing in your target markets, and how these may shape your marketing campaigns.

. . .

Looking to grow your business internationally? Oban can help. Get in touch to find out how.

Oban International is the digital marketing agency specialising in international expansion.

Our LIME (Local In-Market Expert) Network provides up to date cultural input and insights from over 80 markets around the world, helping clients realise the best marketing opportunities and avoid the costliest mistakes.