Sustainability around the world: Spotlight on Iceland

How is sustainability viewed around the world? We spoke to our LIMEs to find out. Part 4 of our blog series focuses on Iceland – find out more.

For many B2B marketing departments, producing high-quality B2B leads is their primary objective. While all brands and products are different and need to be considered in isolation, there are several ways that digital marketing can generally be used to create higher numbers of leads that are both cheaper and more likely to convert. Oban International has worked with a variety of B2B brands on lead generation programs around the world, and below we have distilled some of what we’ve learnt.

The first step towards generating higher quality leads is to get to know your audience better. It is, however, all too easy to skip this step – and many companies do. Some businesses assume they already know everything that matters or merely write off audience research as an academic exercise. It is possible to create a piece of content, promote it online and capture data from a vaguely defined target audience of ‘IT decision-makers’, for example, but the insights generated from thorough audience research can yield unexpected, money-saving tactics that would otherwise be missed. These tactics range from decisions on what content to produce, to which channels are used and the messaging employed.

An excellent first step in audience research is to evaluate the opportunity, especially if your target audience spreads across the globe. If you have already attempted a marketing communications strategy on an international scale, you will have realised the amount of time and budget involved in producing and promoting materials for a variety of countries and languages. Therefore, selecting which countries to prioritise, can yield better results long-term.

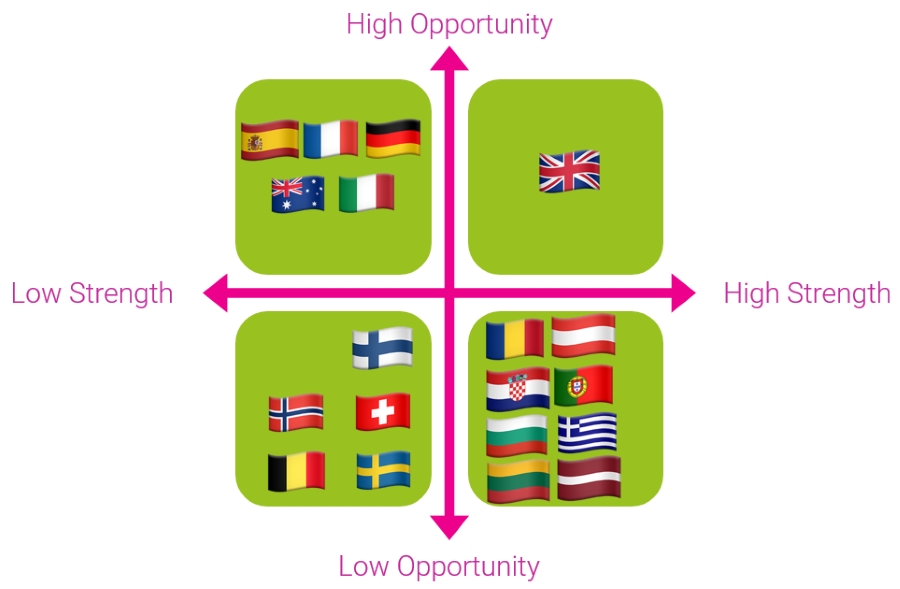

A straightforward way to do this is to plot all your relevant markets by contrasting the amount of total opportunity by your company’s current strength in those markets. To work with an example, imagine your business sells accounting software. Firstly, you can quantify the total opportunity, by market. If you have data on the “total spend on accounting software” you could use that, but other metrics such as “number of accountants” or “average monthly Google searches for accounting software related keywords” can act as a proxy.

Secondly, you want to understand your current strength in each market. A simple way to check is to examine your online conversion rates. The underlying assumption being that a high conversion rate translates into a better return on investment (ROI), while a lower conversion rate may suggest a need to increase brand awareness and consideration before you can generate more leads (as well as user experience (UX)/conversion rate optimisation (CRO) to identify barriers to conversion).

This exercise might tell you that there is a significant opportunity for your business in Germany, but your current performance in the country is faltering. As a result, you may decide to invest more in brand building campaigns aimed at increasing the number of buyers who know about you by the time you reach them with a piece of content. At the same time, you will need to increase your ‘tolerable cost per lead (CPL)’ (or the amount you are willing to pay for a lead). On the other hand, you might find Ireland to be a small country where you are already doing quite well. You should keep investing in this country, but you would use more stringent CPL targets and spend less on brand awareness campaigns.  This exercise should leave you with a shortlist of countries and the beginnings of a strategy on how to approach each cluster. Now that you know which markets represent the most significant opportunity, you can gain a deeper understanding of the audience in each region.

This exercise should leave you with a shortlist of countries and the beginnings of a strategy on how to approach each cluster. Now that you know which markets represent the most significant opportunity, you can gain a deeper understanding of the audience in each region.

Compile all the reports that discuss your industry and see what you can learn about your audience. Who are the main buyers and decision-makers? What role do they occupy in their organisation? Do they shop on price, or not? What features do they look for in a service or product like yours? What triggers their purchase or switching providers?

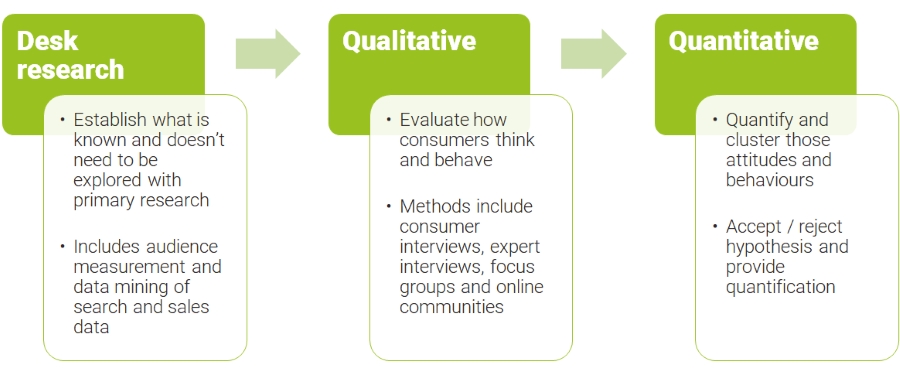

To answer those questions in a way that is genuinely relevant to your industry, there’s no real substitute for primary research.

As a first phase, Oban suggests conducting a low number of semi-structured interviews with primary decision-makers. You could mix customers with prospects to produce different types of insight. Many of Oban’s clients are surprised by how much they didn’t know about their audience and the eye-opening insights they receive.

For the second phase, we recommend surveying a small sample of your target audience. This enables you to test the insight from the initial interviews and quantify attitudes and behaviours. The cost of surveys can be steep for B2B audiences, so it’s worth considering whether desk and qualitative research can do the job well enough to get started.  By the end of this exercise, you should be able to articulate who your target audience is and what they are looking for. This information is incredibly valuable when generating ideas that may influence everything from your proposition to your targeting and messaging.

By the end of this exercise, you should be able to articulate who your target audience is and what they are looking for. This information is incredibly valuable when generating ideas that may influence everything from your proposition to your targeting and messaging.

Content is becoming an increasingly influential factor in B2B purchasing decisions. It can be particularly helpful for those who are learning new disciplines, developing strategies to solve current problems and seeking case studies of similar companies achieving great results. Whether you offer enterprise SaaS to business analysts, international private medical insurance to HR decision-makers or anti-bacterial solutions to the textile industry, content can help you reach your audience, position yourself in the consideration set of B2B buyers, and demonstrate your expertise.

To ensure you create a valuable piece of content for your audience and your pipeline, consider:

Once you have the content, make sure it’s optimised for search engines. The right use of metadata, including hreflang tags when operating internationally, as well as management of page speed (careful with JavaScript and large images), can help the content perform well and be found.

There are two philosophies for content in the context of lead generation. The most traditional approach is data capture. That is, to aim all efforts at creating something so compelling that your target audience can’t help but to exchange their details for access to it. You will be very familiar with this tactic, at least as a consumer of reports and filler of forms. This approach works on the basis that those active leads are approachable by sales teams to work their magic.

The alternative is to make it publicly available; to set it free. You could create a long blog post, as Aberdeen Standard Investments did when they published India: The Giant Awakens, or allow people to download the report – no questions asked – as The Business of Fashion did with their incredibly detailed and illuminating report ‘The State of Fashion’.

While the arguments for gating content are obvious (to obtain data from potential customers), there are also many strong reasons advocating for the opposite.

Firstly, you will reach many more people. If you assume a generous 5% conversion rate from those landing on your data capture form, you would engage 50 instead of 1,000 buyers, 500 instead of 10,000. Freely available content also gets shared more and ranks better on search engines. Depending on the context, you may be able to engage 20 to 100 times more people by not gating it.

Secondly, the experience of gating content becomes cumbersome as more people use smartphones to conduct product research. For most of our B2B clients, mobile accounts from 40 to 60% of total traffic and the data are clear when it comes to performance. The conversion rate for gated content dropped from 2-3% on desktop to 0.2-0.3% on mobile for one of our clients. Is it worth paying to promote material that only translates 0.2% of the clicks into leads?

Lastly, just because you haven’t obtained any data, it doesn’t mean that is the end of the story. In the same way that a data capture form gives you an email (that you can use to contact a lead who remains cold), cookies enable you to keep reaching out to someone who has seen your content. By remarketing to those who have landed on a specific URL, you can now use search, display, video, social and native adverts to either keep promoting more content or for a product message with a stronger call to action.

For those cases where you want to gate content and capture leads, consider the following:

In the end, it is not a black-and-white situation. You should consider how to make the best use of both tactics. Content published without data capture forms can increase awareness and consideration and it can also help you drive users to the content that does sit behind a data capture form. Consider how you can maintain a balance between both.

In the end, it is not a black-and-white situation. You should consider how to make the best use of both tactics. Content published without data capture forms can increase awareness and consideration and it can also help you drive users to the content that does sit behind a data capture form. Consider how you can maintain a balance between both.

Paid media is the last of the core digital marketing elements you should consider when planning your lead generation efforts.

Promoting content to a B2B audience is best done on those platforms that allow you to segment and target people based on their job role or industry. If you are thinking LinkedIn, you’re on the right track!

However, be careful to remain platform agnostic. LinkedIn has great data relating to the job roles and industries of its users, but inventory and costs can be very high. At Oban, we created a content promotion campaign for an enterprise SaaS product on Facebook that generated leads at one-tenth the price of LinkedIn (before qualification). Before making any decisions, make sure you can to follow the lead to the point of sale – or at least qualification – so that you can calculate the cost of each qualified lead. This information will enable you to decide which channels receive the greatest investment.

Finally, ensure that you check the usage of different digital platforms in each country. For example, Americans, Russians and the Chinese all use different search engines and social media platforms (depending on preference as well as local restrictions). During your initial audience research, consider asking which platforms your sample use.

For many B2B organisations, ensuring your pipeline has enough leads to meet your sales targets is critical. As such, it forms an ongoing effort that touches many marketing disciplines from understanding your audience (and which strategies to use) to content marketing, paid media and CRO. Knowing how to make the best use of these disciplines, measure your results and test/optimise for continuous improvement are vital tools in the B2B marketer’s toolkit.

If you would like to see how Oban International can help your B2B business find more leads in any market on the planet, please get in touch.

This article is based on the presentation by Xabier Izaguirre and Chloë McKenna at the B2B Marketing Expo in March 2019. The presentation slides are available below.