Life after Covid-19: The future of international online grocery shopping

Traditionally, groceries have been a slower category for ecommerce growth compared to others. Consumers have been more open to buying clothes or electronics online than fresh food. Reasons for this include:

- Consumer preference for seeing or touching food before purchase, to judge freshness and quality – no bruised fruit or wilted lettuce

- Consumer dislike of substitute items selected for them due to out of stock items

- Problems obtaining a desired delivery window

- A reluctance to pay delivery fees

- Consumer perceptions that online prices are inflated compared to deals they can find in store

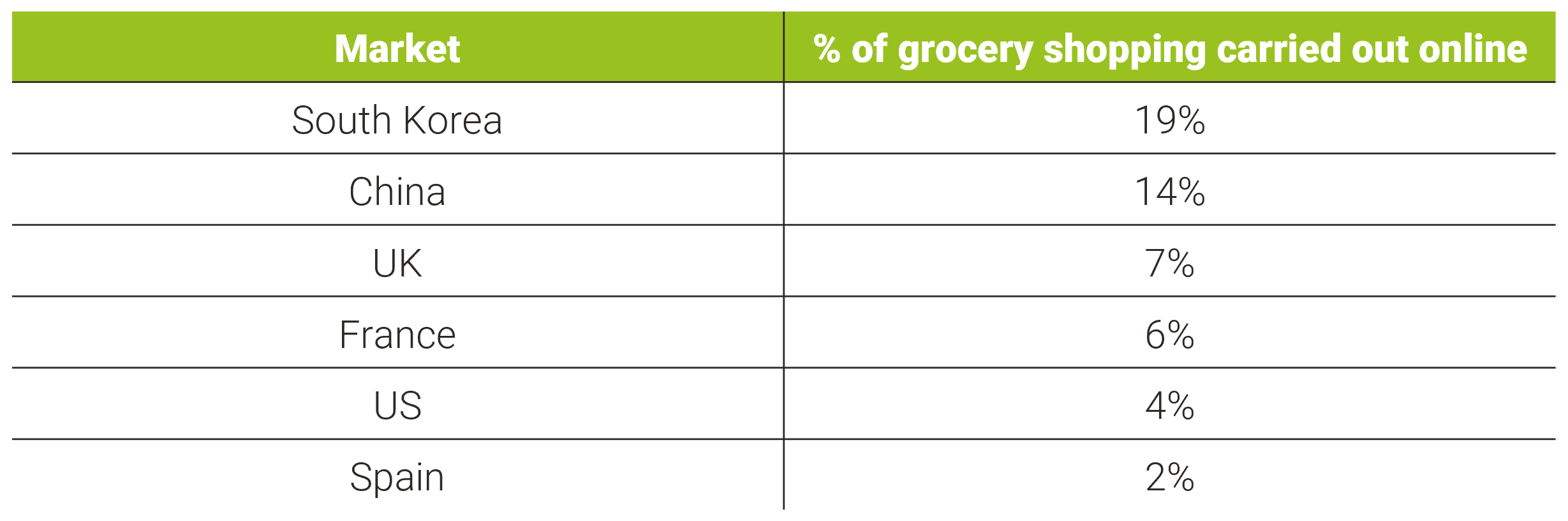

Some Asian markets have been quicker to embrace online grocery shopping, as the table below illustrates:

(Sources: Statista, Bain, Forrester)

Different rates of adoption by market can be explained by differences in:

- Geography – proximity and convenience of local bricks and mortar stores

- Broadband penetration

- Credit card access

- Strength of delivery infrastructure

Cultural differences play a key role too. For example:

- French people tend to buy a fresh baguette at a local bakery each day

- Spaniards like to shop at outdoor markets

- Italians value local shopping, often in small stores (“botteghe” – that is, butchers, bakeries, greengrocers, delis and the like)

A decade ago, many analysts were predicting a much higher percentage of online grocery shopping by now – predictions which have failed to materialise.

But that was before Covid-19.

The pandemic has led to a surge in demand

As consumers sought to avoid stores or at least minimise visits, rates of online grocery shopping have soared around the world:

- In Italy, at the height of its lockdown, supermarket chain Carrefour said online customers had doubled to 110,000. Sales via its partnership with logistics start-up Glovo increased more than 10-fold

- In France, online orders for home delivery rose 32% YoY in early March, while click-and-collect orders rose 29%

- In the US, online grocery sales increased as much as 5-fold

- In the UK, the Government asked grocers to work together to deliver to 1.5m vulnerable households

The surge in demand has magnified pain points

The crisis left grocers struggling to keep up:

- The volume of existing and new customers overwhelmed many of the online grocery websites:

- Some customers were unable to obtain online delivery slots at all, let alone at convenient times

- Regular customers lost their regular slots and were forced to shop elsewhere

- Carrefour and others installed virtual queuing systems to control the number of people shopping on their websites – at one point queues were several hours long

- Once onsite, the experience was slow, with some orders failing during checkout

- Many grocers, such as Italian grocer Esselunga restricted orders to one per week

- In Spain, at one point the Mercadona supermarket chain stopped taking online orders in most of the country

- In the UK, Ocado suspended its customer telephone support system and closed the website overnight

- Hastily put together amends such as reduced ranges or limited numbers of items, led to poor user experience, compounded by the number of new users

Grocers with physical stores have been able to adapt more quickly by setting aside time when supermarkets are closed to pick online orders or by extending click and collect or home delivery services to more outlets:

- In the UK, Tesco more than doubled its number of delivery slots, including click and collect, to 1.2m in six weeks

Online grocery specialists such as Ocado struggled to expand at the same rate, mainly because the robot-driven facilities it relies upon take a longer time to build.

The shift in consumer behaviour will drive digital innovation

As a result of the pandemic, many people have been exposed to online grocery for the first time – pushing past barriers to entry by downloading apps and trying new services. Some of these behaviours will stick, especially as customers strive to avoid heavily trafficked stores in the months ahead.

This increased demand for online groceries will accelerate the category and drive innovation, as grocers rise the challenge of fulfilling orders. Whilst social distancing becomes part of our daily lives, grocers are prioritising online developments. We will see more investment in improving supply chains, integrating physical stores with shopping technology, and increasing automation. For example:

- More autonomous vehicles, drones and robots to help with issues of last mile delivery

- Greater use of artificial intelligence to control supply chains, forecast demand, streamline operations, answer customer queries and manage pricing

- More digital experiences in-store, especially via mobile, from providing promotional information whilst the customers queue to streamlining the instore journey

- Even greater use of omnichannel data to allow retailers to provide ever more personalised customer experiences –such as their preferred day and time of day to shop, dietary preferences, whether they have children or pets, their favoured brands – all to improve the retail experience

Consumer expectations have been dampened due to the crisis, with many customers happy simply to obtain a delivery slot and the products they require. Their focus on specific brands and price promotions has diminished. As the crisis fades, consumer expectations will ramp back up, including the return of sensitivity to prices – especially as customers feel the effects of an economic downturn.

The pandemic has forced online grocery trial onto many consumers and the experience so far has been mixed. This is a chance for the online grocery retailers to convert those reluctant triallists into regular and loyal shoppers, but only if the infrastructure improves at pace ready to cope with any future lockdowns.

Oban can help

Covid-19 is changing consumer behaviours and disrupting industries. Now is the time to optimise and promote your website, and potentially diversify your business by expanding into new markets. To find out how Oban can help you sustain competitive advantage, please get in touch.

Chloë McKenna | Director of New Business

Oban International is the digital marketing agency specialising in international expansion. Our LIME (Local In-Market Expert) Network provides up to date cultural input and insights from over 80 markets around the world, helping clients realise the best marketing opportunities and avoid the costliest mistakes.