Online payment methods around the world: Part 1 – Europe

For global e-retailers, ensuring you have the right payment options on your website in each market is a key component of success. Why? Well, research varies but suggests that up to 70% of customers around the world have abandoned a website because they weren’t satisfied with the payment methods on offer. Providing prospective customers in each market with payment options relevant to them is important to establish trust and familiarity – essential for conversion – but in such a fragmented and continually evolving landscape, where do you start?

In this series, we’ll be taking a look at how online payment methods vary around the world and the key things to know. This post focuses on Europe, but future posts will cover every region of the world. The series will conclude with a look at the trends shaping the industry in the years ahead.

Digital wallets and credit cards dominate in Europe

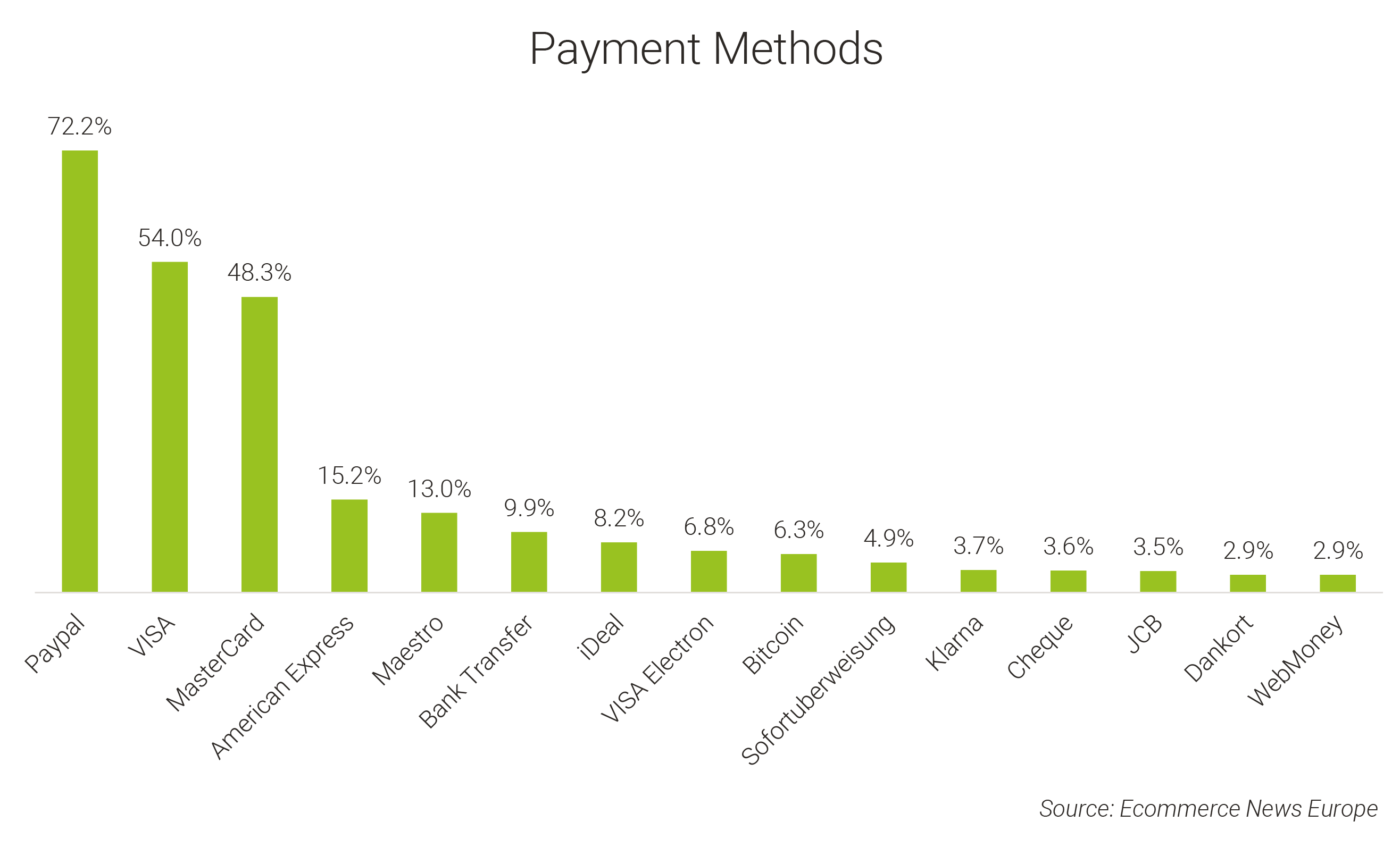

The chart below gives an indication of payment methods by popularity around Europe.

Currently, digital wallets and credit cards are the dominant payment methods in Europe. Paypal is the leading digital wallet brand and Visa the leading credit card, and in almost every European country, the top two online payments brands are one of these two.

That isn’t the full story though:

- In the Netherlands a majority of the population (over 80%) use iDeal, the national payment method, for purchases. If you’re trading in the Netherlands, offering iDeal is essential

- In Germany, consumers often prefer to pay by invoice or direct bank transfers. Non-credit card payment methods such as SEPA direct debit, SOFORT, and Giropay account for a significant proportion of online transactions

- In Eastern Europe, cash on delivery still exists (a similarity with markets further afield such as India and Brazil, which we’ll explore later in the series)

- In Poland, online banking called Pay-by-Links is the most popular online payment method

In Russia, despite its market size, credit cards are not dominant. Instead, the most popular local payment methods are cash on delivery, online banking and digital wallets, including:

- Yandex.Money – the most popular digital wallet with top-up options including prepaid scratch cards, plastic cards, online banking, and cash

- QIWI Wallet – another digital wallet that can be topped up at one of 150,000+ payment terminals, as well as with credit/debit cards, on a phone

- Sberbank – The biggest bank with 40 million users

Europe lags behind other global regions such as Asia-Pacific in terms of mobile payment adoption. That said, the use of payments on smartphones, tablets and wearables is rising, with Scandinavian countries and the UK leading the way, especially mobile payments in-store.

What about cryptocurrencies, which generate so much news? The Independent reported last month that the European Union is considering the development of its own digital currency, to rival Facebook’s Libra cryptocurrency. This would echo China’s state-backed efforts to do the same.

Later in the series, we’ll explore how other regions of the world differ from Europe when it comes to online payment methods. Meanwhile, if you’d like to find out how a local in-market expert can help you with your online payments strategy, please get in touch.

Az Ahmed | Marketing Manager

Az Ahmed | Marketing Manager

Oban International is the digital marketing agency specialising in international expansion. Our LIME (Local In-Market Expert) Network provides up to date cultural input and insights from over 80 markets around the world, helping clients realise the best marketing opportunities and avoid the costliest mistakes.